Welcome to the whimsical world of Business Taxes, where every deduction is a treasure hunt and filing is more exciting than watching paint dry—well, almost! Here, we’ll unravel the mysteries of business taxes like a magician pulling rabbits from a hat, except instead of a rabbit, we might pull out a hefty deduction or two.

We’ll explore the types of business taxes, how to navigate the labyrinth of filing, and those glorious deductions that can lighten your financial load. It’s a thrilling journey through numbers, forms, and perhaps a sprinkle of stress, but fear not! By the end, you’ll be equipped to tackle your business taxes with the grace of a dance-off champion.

Understanding Business Taxes

When it comes to running a business, tax season can feel like a game of dodgeball – except instead of balls, it’s a flurry of forms, deductions, and deadlines coming at you. Understanding business taxes is crucial to keeping your sanity intact while ensuring that the taxman doesn’t come knocking too hard on your door. From the types of taxes your business may face to the various deductions you can utilize, getting a grasp on this subject is as important as knowing your product line or service offerings.

There are several types of business taxes lurking in the shadows, each with its own quirks and requirements. Whether you’re a sole proprietor or the CEO of a sprawling corporation, knowing the specifics can help keep your financial ship sailing smoothly. The key types of business taxes include income tax, self-employment tax, payroll tax, and sales tax, among others. Each tax plays its role in the grand symphony of business operations, and understanding them is your first step toward harmonious financial management.

Types of Business Taxes

Different businesses encounter various taxes, each with unique implications for their financial health. Familiarity with these taxes ensures compliance and can lead to significant savings when it comes time to file. Here’s a breakdown of the major types of business taxes you might encounter:

- Income Tax: Businesses must pay taxes on their profits, which varies based on the business structure – corporations face different tax rates than sole proprietors.

- Self-Employment Tax: For those running the show solo, this tax covers Social Security and Medicare, so make sure you don’t dodge it!

- Payroll Tax: If you have employees, you’ll need to pay taxes on their wages, which includes contributions to Social Security and Medicare.

- Sales Tax: This tax is collected from customers on sales of goods and services and then forwarded to the state. Don’t forget to add it to your price tags!

- Franchise Tax: Some states impose a franchise tax for doing business in their jurisdiction, which can be based on revenue or a flat fee.

Understanding these tax types is only half the battle; filing them correctly is where the rubber hits the road. The filing process can seem as daunting as a high-stakes poker game, but with the right strategy, you can come out on top.

Filing Business Taxes

Filing business taxes involves a series of steps that can vary greatly depending on your business structure. Here’s a general Artikel to help guide you through the process and minimize your chances of a tax-related meltdown:

1. Gather Financial Documents

Collect all necessary documentation, including revenue records, receipts for expenses, and previous tax returns. Think of it as gathering your battle gear before heading into the fray.

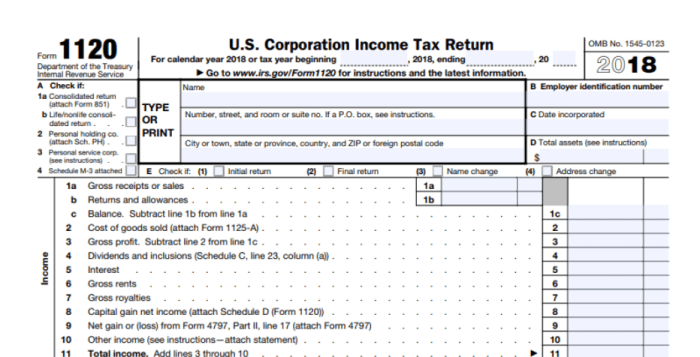

2. Choose the Correct Tax Form

Different business structures require different forms. Sole proprietors typically use Schedule C, while corporations will use Form 1120. Selecting the right form is critical; you wouldn’t want to submit a battle strategy for a board game, would you?

3. Calculate Your Income and Deductions

Determine your total income and any eligible deductions. The IRS loves deductions, so don’t let them slip through your fingers like a runaway balloon at a birthday party.

4. File Your Taxes

Submit your forms either electronically or via mail before the deadline. Procrastination won’t win you any favors with Uncle Sam!

5. Pay Any Outstanding Taxes

If you owe taxes, be sure to pay by the due date to avoid penalties. Think of it as tipping your waiter – it’s just good manners.

Now, let’s not forget the treasure chest of common deductions available to businesses that can help lighten your tax load.

Common Deductions for Businesses

Deductions are like the magical fairy dust that can help reduce your taxable income. It’s essential to know what you can and cannot deduct to make the most of your financial strategy. Below are some common deductions that businesses can take advantage of:

- Business Expenses: Any expense necessary for running your business, such as office supplies, utilities, and rent, can typically be deducted.

- Vehicle Expenses: If you use your vehicle for business purposes, you can deduct either actual expenses or the standard mileage rate. Just keep track of those road trips!

- Home Office Deduction: If you work from home, you can deduct expenses related to the portion of your home used for business. But be ready to prove your workspace isn’t just an elaborate setup for binge-watching cat videos.

- Employee Wages: Salaries and wages paid to employees are deductible, which means you can help fund your team’s coffee habit while also slashing your tax bill.

- Advertising Costs: Any cost associated with promoting your business, from social media ads to flyers, can be written off.

Remember, the key to mastering business taxes is understanding the rules of the game and leveraging every available deduction to keep your profits in your pocket!

Navigating Personal Finance and Loans

When business taxes come knocking at your door, it’s not just your business that feels the pinch; your personal finance can also take a hit. Imagine taxes as that unexpected guest who shows up at the party and consumes all your snacks—what a bummer! Understanding how these taxes affect your personal finances is crucial for maintaining financial balance and avoiding a meltdown of epic proportions.

Navigating through the vast sea of personal finance and loans requires both skill and a dash of bravery. With various loan options available, it’s essential to know which routes can lead to treasure and which ones might just be a mirage. Below, we’ll Artikel some personal loan options that can help you when the tides of business tax season get a bit choppy.

Overview of Personal Loan Options

When considering personal loans, it’s vital to explore the different types available and their respective advantages. Here’s an overview of common personal loan options that can help keep your finances afloat when business taxes try to sink your ship:

- Secured Loans: These require collateral, like your shiny new trampoline, ensuring lower interest rates. Just don’t let the trampoline leap away with your finances!

- Unsecured Loans: No collateral needed, just your stellar credit score. It’s like asking for a favor from a friend—if they trust you, they might just say yes!

- Debt Consolidation Loans: These can roll multiple debts into one shiny package, often at a lower interest rate. Think of it as the Marie Kondo of loans—tidying up your financial clutter!

- Personal Lines of Credit: This option gives you access to a credit limit that you can withdraw from as needed. It’s like having a friend with an emergency stash of snacks—always there for you in crunch time!

Impact of Payday Loans on Financial Stability and Tax Obligations

Payday loans can be tempting, especially when you’re knee-deep in taxes and running short on cash. However, they often come with exorbitant interest rates that can create a vicious cycle of debt. Here’s why they’re like that one friend who always borrows money but never pays it back:

- High Interest Rates: The interest on payday loans can range from 200% to 500%, which is like buying a small car but getting a bicycle instead.

- Short Repayment Terms: Typically due upon your next paycheck, these loans can lead to financial distress as borrowers scramble to repay them.

- Tax Implications: Failing to manage these loans responsibly can lead to an increase in taxable income if you can’t pay them back, resulting in a tax bill that’s as unwelcome as a surprise visit from the in-laws.

- Cycle of Debt: Missing a payment can lead to needing another payday loan to cover the first one, creating a financial black hole. It’s like trying to escape a labyrinth but ending up at the same dead end!

“While payday loans might seem like a quick-fix solution, they can turn into a financial nightmare quicker than you can say ‘interest rates’!”

Philanthropy and Taxes

In the world of business and personal finance, philanthropy is not just a warm, fuzzy feeling; it can also be a tax-saving strategy that makes you feel as good as a puppy in a room full of squeaky toys. Charitable giving offers a buffet of tax benefits both for individuals and businesses. Let’s dive into the treasure trove of tax deductions and credits that come with lending a helping hand.

Tax Benefits of Charitable Giving

When it comes to giving, the IRS wants to play too! Donating to qualified charities can provide you with significant tax benefits, transforming your good deeds into delightful deductions. Here’s why you might want to consider befriending your local charity:

- Individuals can deduct cash contributions up to 60% of their adjusted gross income (AGI) when donating to public charities, which is like getting a VIP pass to the tax deduction club.

- Businesses can deduct up to 25% of their taxable income in charitable contributions, turning generous acts into financial strategies that even accountants might applaud.

- Donating appreciated assets, such as stocks, allows you to deduct the fair market value without having to pay capital gains taxes—let your profits go to charity without the taxman taking a cut!

“Giving is not just about making a donation; it’s about making a difference.”

Implications of Structured Settlements on Taxes

Structured settlements are often like those mysterious gifts that you can’t quite figure out how to use. While they provide a steady stream of income over time, they also come with tax implications that can make your head spin faster than a hamster on a wheel. Here’s what you need to know:

- Generally, the money received from a structured settlement is tax-free. This means that every month, you’re not just receiving cash; you’re effectively winning the lottery without the tax bill!

- However, should you decide to sell your structured settlement, the new buyer might have to pay taxes on the gains, which is like giving away your birthday cake only to find out they took a slice for Uncle Sam.

- Remember, life insurance proceeds used to fund structured settlements are also typically tax-free, which is a bright spot in the otherwise cloudy world of taxation.

Student Loans and Their Tax Deductibility Options

Student loans can feel like a ball and chain when you’re trying to run the race of life, but they come with some tax perks that might lighten your load. Understanding these options can help you navigate the labyrinth of taxes and education financing:

- The student loan interest deduction allows you to deduct up to $2,500 of interest paid on qualified student loans, which can make a significant difference when tax season rolls around like an uninvited guest.

- This deduction phases out for higher-income earners, but it’s still a sweet deal for those who qualify. Think of it as a tax discount for those still paying their dues to the educational system.

- Many states also offer additional tax benefits for student loans, so check your local regulations for potential savings that might feel like finding a hidden stash of candy in your desk drawer.

Summary

So, as we wrap up this rollercoaster ride through the land of Business Taxes, remember that knowledge is power! Armed with insights on deductions, filing processes, and even a dash of personal finance, you can stride into tax season like a confident superhero, cape billowing in the wind. Now go forth and conquer those business taxes like the boss you are!

Questions and Answers

What are the different types of business taxes?

Businesses typically face income tax, payroll tax, sales tax, and property tax, among others.

How can I prepare for filing business taxes?

Keep accurate records, organize receipts, and consider consulting a tax professional to avoid the tax-time chaos.

What common deductions can I claim for my business?

You can often deduct expenses like office supplies, travel costs, and employee wages, but consult a tax advisor for specifics!

How do business taxes impact my personal finances?

Business taxes can affect your net income, which in turn impacts personal savings and investment opportunities.

Are charitable contributions tax-deductible for businesses?

Yes! Businesses can often deduct charitable donations, so giving back can lighten your tax burden while doing good.